CouponCourt.com may earn a small commission via affiliate links in this post. Learn More

Additionally, CouponCourt.com does not claim to represent the manufacturers, brands, companies, or retailers mentioned on this website, nor do we own their trademarks, logos, marketing materials, or products. If you wish to submit a copyright claim, please do so here.

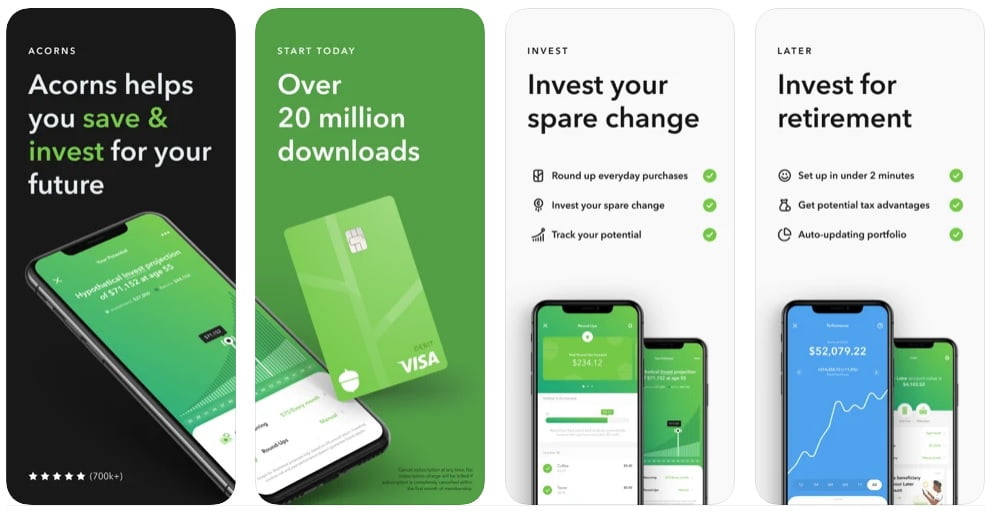

It’s back if you missed it before! You have the opportunity to become a new Acorns customer and get a sweet deal!

Right now, you can score $20 credit when you sign up and make your first investment of as little as $5!

That means you can even invest spare change and start earning more!

If you want to make the most of your spare change and get the occasional retailer kickback, there’s really no better place to do that than Acorns. The automatic roundups at Acorns make saving and investing easy, and most investors will be surprised by how quickly those pennies accumulate.

Here’s How To Get This:

- Go here to visit Acorns

- Click on “Get my $20 Bonus”

- Enter your email address

- Create an account

- Link your bank account

- Deposit at least $5

- Receive $20 credit!

Additional Perks:

Why Acorns? In under 3 minutes, start investing spare change, saving for retirement, earning more, spending smarter, and more. The average Acorns customer invests $166 within 4 months just by rounding up spare change!

- Fast and easy account setup ($3 or $5 a month)

- Different subscription options (personal and family)

- Cash-back rewards program

- Educational articles and videos from financial experts

How Acorns Manages Your Money

Like most other robo-advisors, Acorns gives its customers a diversified portfolio of low-cost ETFs suited to their risk tolerance and goals, based on how they answer a handful of questions.

You’ll be asked your age, net worth, income and when you may need to access the funds. Acorns picks your portfolio from a roster of nearly 25 ETFs. Forbes Advisor signed up with a profile for a young, upper-middle-class worker with a long investing horizon. Acorns came back with an “Aggressive Portfolio” that allocated:

- 55% to large domestic companies through Vanguard S&P 500 (VOO)

- 30% to international stocks through iShares Core MSCI International Stock (IXUS)

- 10% to mid-cap stocks through iShares Core S&P 500 Mid-Cap (IJH)

- 5% to small-cap stocks through iShares Core S&P 500 Small-Cap (IJR)

[ CLAIM OFFER ]

Learn how Acorns works

Acorns is best for:

- Hands-off investors.

- People who struggle to save.

- Earning cash-back rewards.

Pros

- Automatically invests spare change.

- Cash back at select retailers.

- Educational content available.

- No account minimum ($5 required to start investing).

Cons

- Monthly fees can be significant for small balances.

- $35 per ETF to transfer funds to another broker.

- No tax-loss harvesting.

Recent Comments